Get prepared to make tax-time easier

There are always lots of tax-related tasks to complete every EOFY, but as we move into the upcoming financial year, it is also worth getting to grips with new tax changes the Government’s election promises will usher in on 1 July, which we’ve outlined below.

New 2025-2026 tax changes

During the election campaign, the Labor government announced a number of tax changes.

These include the introduction of a standard $1,000 deduction for work-related expenses for taxpayers with labour income, a 20 per cent reduction in HECS-HELPS debts, and an extension of the $20,000 instant asset write-off until 30 June 2026.

Legislation has already been passed to cut the tax rate for individuals and is effective from 1 July 2026. The rate for income between $18,201 and $45,000 will be reduced from 16 per cent to 15 per cent, with a further reduction to 14 per cent in the following financial year.i

The government has also made it clear it intends to proceed with its draft legislation (Division 296) reducing the tax concessions for super accounts with a balance exceeding $3 million. This legislation will double the tax rate on earnings related to the portion of the balance over $3 million from 15 per cent to 30 per cent.

Now, let’s look at a few ways you can get prepared in the lead up to 30 June.

Start your tax preparations now

The ATO has announced its tax time hitlist, so it’s also important to check your current tax arrangements are not going to leave you vulnerable to an audit or significant penalties. The main focus for the ATO this year is work-related expense claims, investment properties and holiday home claims, and sharing economy income and cryptocurrency.i

With the ATO taking a much tougher stance on both tax reporting and payments, make sure you lodge and pay on time, or you could face penalties and interest charges. From 1 July 2025, interest paid to the ATO will no longer be tax-deductible.

Tips for businesses

Review and update all of your financial records and identify expenses that could be deductible.

You may want to make some deductible purchases prior to EOFY to help reduce your taxable income for the financial year. The small business instant asset write-off limit for 2024-25 is $20,000.ii

Also check your debtors, inventory and fixed assets, and ensure you write-off any debts that are not recoverable. Review any capital gains and losses and consider offsetting the gains with capital losses.

Check all required super contributions for employees have been made, plus any additional contributions for business owners. Ensure these contributions are received by the funds specified cut-off date to qualify for any tax deduction.iii

To-do list for personal tax

Getting your personal tax information prepared is also important, particularly given the ATO’s focus on personal deduction claims.

If you have regular deductible expenses (such as interest on investment loans and annual payments), consider prepaying them before 30 June so you can claim a deduction this financial year.

If you are likely to have personal capital gains tax obligations from the sale of assets, consider whether you should try to offset them against capital losses.

Time for some super contributions

Consider making extra personal super contributions before the financial year ends if you can.

Before making any contributions, check the total amount of both your concessional (before-tax) and non-concessional (after-tax) contributions across all your super accounts to ensure you do not exceed the annual cap limits.iv

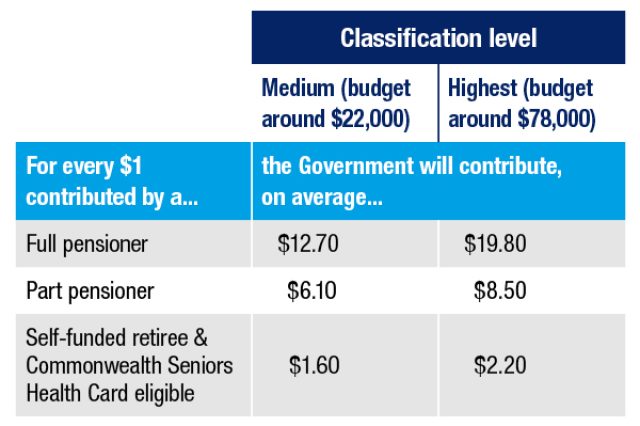

Other super contributions to consider include personal tax-deductible contributions, contributions on behalf of your spouse and eligible contributions that could earn you a co-contribution from the government.v

If you would like to discuss EOFY preparations for either your personal tax or business, please call our office today.

i ATO unveils ‘wild’ tax deduction attempts and priorities for 2025 | Australian Taxation Office

ii Instant asset write-off for eligible businesses | Australian Taxation Office

iii Missed and late super guarantee payments | Australian Taxation Office

iv, v Caps, limits and tax on super contributions | Australian Taxation Office